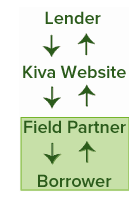

Kiva is a non-profit organization that seeks to alleviate  poverty through online loans. One of Kiva’s challenges is how to help the poorest of the poor, and not just the moderately poor. Kiva’s website allows individuals in the “first-world” to give micro-loans in $25-increments to poor borrowers in the “third-world”. In order to make this happen, Kiva partners with over 100 global microfinance institutions (MFIs), essentially banks that lend small amounts of capital to the poor, that operate on the ground in the developing world. After an MFI passes a risk screening process, it becomes a Kiva Field Partner and is given access to list its borrowers and their loans on Kiva’s website to seek funding from Kiva lenders. Kiva distributes the capital from the lenders to these MFIs, which distribute to Borrowers. When Borrowers make payments on their loans, the money is distributed back through the MFIs to Kiva to Lenders.

poverty through online loans. One of Kiva’s challenges is how to help the poorest of the poor, and not just the moderately poor. Kiva’s website allows individuals in the “first-world” to give micro-loans in $25-increments to poor borrowers in the “third-world”. In order to make this happen, Kiva partners with over 100 global microfinance institutions (MFIs), essentially banks that lend small amounts of capital to the poor, that operate on the ground in the developing world. After an MFI passes a risk screening process, it becomes a Kiva Field Partner and is given access to list its borrowers and their loans on Kiva’s website to seek funding from Kiva lenders. Kiva distributes the capital from the lenders to these MFIs, which distribute to Borrowers. When Borrowers make payments on their loans, the money is distributed back through the MFIs to Kiva to Lenders.

Kiva currently boasts an impressive 98.98% payback rate on their loans to date, which gives lenders confidence that they won’t lose money. This high payback rate reflects a low default rate on the borrower side, and Kiva maintains this low default rate by carefully selecting responsible MFIs. Since MFIs benefit tremendously from a Kiva partnership, there is an incentive for these banks to post what they believe to be the safest, lowest risk loans on Kiva’s website, and shy away from higher default rates. However, if Kiva wants to move toward serving the poorest of the poor, it may need to take on greater risk and accept higher default rates.

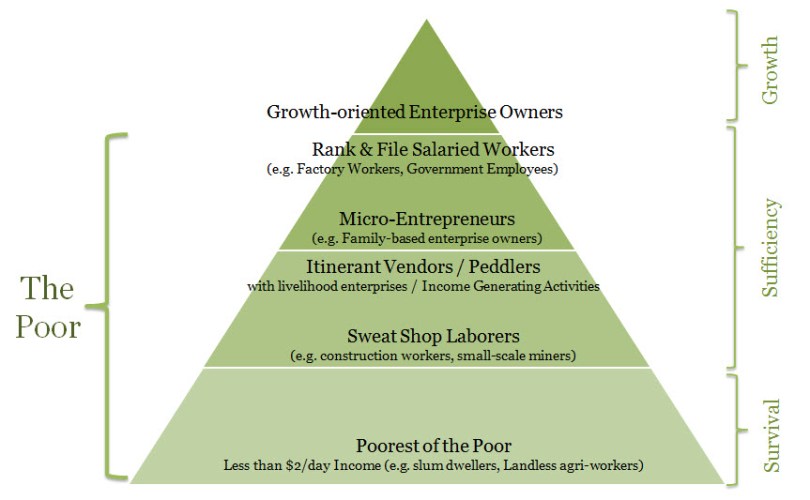

Below is CCT’s Poverty Pyramid, which breaks out the poor into many groups:

Many MFIs target the Sufficiency level rather than the Survival level, which makes business sense because the microfinance industry needs to prove that its business model works in order to gain more support – the more success stories, the better.

The Model

After seven years of operations and a significant amount of publicity, Kiva may be at a place where it can focus more effort on the “Survival” group of the pyramid. We want to explore some of the ways Kiva can, or already has, pursue initiatives to accomplish this mission.

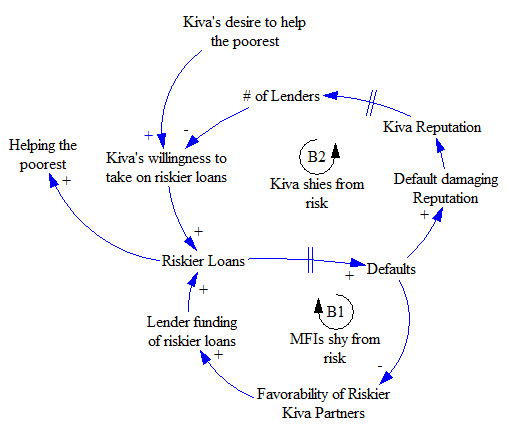

The following model shows how efforts to serve the poorest may play out, captured through the variable “Riskier Loans” (plus sign means same direction, minus sign means opposite direction):

In order to serve the poorest, Kiva must list riskier loans that will likely lead to more default. As the default rate grows, fewer online lenders will get their payback. This could damage Kiva’s reputation, leading to a loss of frustrated lenders and maybe even negative word of mouth that makes it more difficult for Kiva to attract new lenders. Kiva would be likely to respond to this public relations challenge by taking measures to decrease the default rate, which is synonymous with less risky loans to less needy people. Their desire to retain lenders overwhelms their desire to help the poorest and defeats their original initiative. This process is captured in the Kiva shies from risk balancing loop.

Similarly, as MFIs take on riskier loans in order to serve the poorest, these MFIs will appear less favorable to lenders. Kiva formalizes the importance of a MFI’s default rate by showcasing it as a key metric on each borrower/loan page. Individual online lenders will be less likely to fund loans associated with risky institutions, and this decrease in financial support will discourage banks from taking risky loans in the future. This process is captured in the MFIs Shy From Risk Balancing Loop.

These two balancing processes show how the policies and lender expectations at Kiva can get in the way of helping the poorest. When Kiva does something to ramp up the amount of loans to the poorest, the system responds in a way that discourages both Kiva and the MFIs from continuing to carry out the effort. This situation fits a system archetype called policy resistance, where strong balancing loops surround the variable that we want to change. When a system seems to stubbornly resist our efforts, it’s a good time to take a step back. Before pushing our new initiative, we can weaken some of the existing balancing feedback that stand in the way or introduce new reinforcing processes to help build momentum in lending to the poorest.

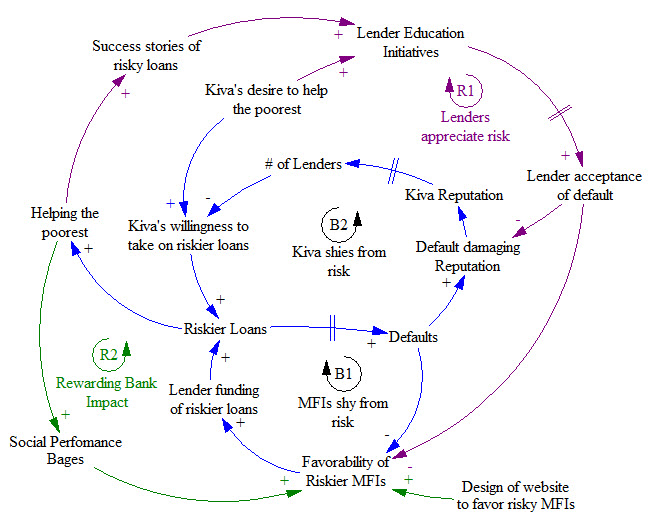

Let’s take a look at some interventions to respond to policy resistance:

Intervention 1: Lender Education

One thing that Kiva would like to do is change the way that their online lenders view risk. Since risk is necessary for helping the most disadvantaged, more risk and default should be a sign of a higher impact investment, at least to some extent. Kiva must ask: What level of risk would our online lenders be comfortable with? If they would be okay with a payback rate closer to 90%, then Kiva would be able to do a lot more for the poor. So it is necessary that Kiva educate lenders and change their perception of risk before they can sustainably take on riskier loans. Additionally, Kiva can build momentum as their investments help the poorest and gather success stories to feed back into their education initiatives. This could introduce a reinforcing loop that helps lenders appreciate risk (R1).

Intervention 2: Reward Behavior We Want to See Continue

One thing that Kiva has already done is introduce Social Performance Badges to help capture an MFIs more qualitative qualities such as having an Anti-Poverty Focus. These badges allow Kiva to provide more visibility to lenders that certain MFIs help the poor with the hope that lenders will then support those MFIs to do more and continue giving risky loans (R2). However, unlike default rate, which is a continuous variable, the badges are a simple on/off switch – an MFI either has the badge or it doesn’t – which fails provide feedback that rewards them for doing better and better. In this sense, the effect of the Social Performance Badges weakens rather than strengthens as more banks lend to the poorest. A more effective metric to drive this reinforcing process would need to be a continuous variable such as the cumulative number of loans to the extremely poor.

Intervention 3: Favor the MFIs that Serve the Poorest

Kiva has full control to make the MFIs who serve the poorest more visible on the website so that they will be more likely to receive funding. For example, Kiva’s Lending Page has a Featured Loans section that is currently devoted to showcasing Group Loans, Arab Youth Loans, and Finish Line Loans (loans that are almost 100% funded but need just a bit more capital). The fact that these three are featured indicates that Kiva is pursuing a multitude of goals, some of which take precedence over the goal to serve the poorest of the poor, at least in the nearterm.

Kiva can also re-evaluate the current amount of data transparency, and find ways to better leverage the statistics that are being shared with lenders. Currently, each MFI’s biography page contains a lot of data, and it’s up to the lenders to decide how much time they want to spend exploring each metric and figuring out what these metrics mean holistically. Kiva can tell a story with the data rather than allow potential lenders to construct their own story out of the numbers.

A look at Kiva’s Field Partners page shows that efforts are being made to highlight Social Performance Badges. But we also see “Delinquency Rate” and “Default Rate” in the table. This may push lenders toward funding MFIs with many badges and low default rates, when perhaps the ones that show great promise and potential growth are not quite there yet with badges, and are meanwhile taking on greater amounts of risk. Based on the three MFIs below, one would be quite inclined to choose VisionFund over the other two. This could lead to a reinforcing loop where the successful MFIs will continue being successful because they present attractive data.

The decision to pursue new efforts is always a complex one – spending more time teaching lenders about risk means less time pointing out other initiatives such as Kiva’s new partnership with a university to facilitate education loans. Overemphasizing the Anti-Poverty Badge means less emphasis on other important areas such as Innovation and Savings services. Kiva has done a tremendous job over the years allowing lenders to make their own choices, and an aggressive campaign to influence behavior in one particular direction may violate one of Kiva’s even greater values – the freedom to choose. Kiva has built up a successful, transparent system that gives over 1 million lenders confidence in making 450,000 loans to people across the world despite limited cultural and social connections. As Kiva explores how to best guide those lenders to serve their mission, they will have to find the proper balance of educating lenders to view risk differently and highlighting data in support of MFIs that take meaningful risks in order to help the poorest.

Written by Andrew Frangos & Jenny Zhou

Thank you for the great post. I really enjoyed reading it. One question that I had and I hope that you can answer is how you would expect to police the actions of the lending middlemen themselves, the MFIs. I very much wanted to learn more about how kiva does this already but it does not seem like it was the focus of your post. That being said, I am wondering if maybe some of the reasons people are not comfortable with taking on more lending risk is because they do not understand the entire process, especially that of the MFIs themselves. Reviewing your model, I am not sure but I do not think I saw connection between the consumer lenders and the MFIs. If I did miss something, would love to hear your thoughts on this aspect. Thank you.

Jonathan, you’re absolutely right that we haven’t captured peoples’ understanding of the lending process in the model, and that is definitely a variable that affects people’s willingness to lend through Kiva in the first place. One way we could have included this was by having a variable called “Lender Education of Kiva Process”, which could affect a variable called “Total Lender Funding”, which then affects the “Lender Funding of Riskier Loans” variable currently in our model. However, there are some good reasons not to include that variable. First, our model focuses on the group of lenders already using Kiva’s website and how to get the converted users to fund riskier loans. Therefore, a large assumption we make is that the population of total lenders will always be there – the question is, can we get them to take more risk? If we were to instead build a model about how Kiva can increase its user base, then there would definitely be a need to incorporate “Lender Education of Kiva Process”. For this model and question, however, adding such a variable wasn’t important to us. You are right, however, that this variable is an integral part of what Kiva thinks about in normal operations. With all models, we have to find a balance between representing the system accurately and creating a model that isn’t too cluttered (at which point we take out variables that may not be central to the question at hand).

It’s so comprehensive! Thanks for sharing! I like how you listed three potential intervention methods / fixes on how Kiva can do better at helping the poorest of the poor. Are these points that Kiva is already exploring / taking action on? If not, you should share this post / model with them 🙂

It seems like there’s potential for symmetry in a couple of the potential interventions. In addition pushing lenders and MFIs to accept riskier loans, couldn’t education and social reward incentives, through say business education, help the poorest decrease the risk of their loans?

Great point Sam! We would definitely want to consider borrower education and figure out how much this could decrease risk in this class of borrowers. Then we could find the right balance between that and lender education. We could add this into the model as a variable that decreases default rate. Or some re-framing might be helpful since the model was built with the assumption that taking on the poorest lenders automatically equates to higher risk.

I think you’re right about the symmetry. Kiva could increase the incentive to offer business education by making it a requirement for some social impact badges or find ways to encourage lenders to contribute to the cost of business education as a forward-thinking ‘insurance policy’ on the loan.